| ||||||||||||||||||||||||||||||||||||||

|

About Us > Statement On Sustainability Statement On SustainabilityAS A RESPONSIBLE BUSINESS GROUP, AFFIN HOLDINGS BERHAD GROUP RESPONDS TO COMMERCIAL AND SUSTAINABILITY CHALLENGES IN A WAY THAT BUILDS MUTUALLY SATISFYING RELATIONSHIP THROUGH OUR PRODUCTS AND SERVICES. ASSESSING THE NEEDS OF OUR STAKEHOLDERS AND IDENTIFYING MATERIAL ISSUES ALLOW US TO OPERATIONALIZE CHANGES IN A MORE EFFECTIVE MANNER. Our fundamentals must be right with products and services that offer value and enrich the lives of our customers and the community as a whole. With still much to do in embedding sustainability across the business, we are committed to continue with efforts and initiatives that will help us achieve the desired outcome. This statement on sustainability explains our aims with regard to balancing economic, environmental and social issues as they relate to the activities of the Group and our continued efforts in achieving them. This statement applies throughout the Group and governs our approach to all our sustainability activities. The subsidiaries’ sustainability efforts will as much as possible be aligned to the Company’s sustainability strategies.

ENGAGING STAKEHOLDERS Building on our close relationship with our stakeholders through the years, we have institutionalised various channels to reach out to different parties. Ours is an ongoing commitment to reinforce relationships while working in tandem with stakeholders to seek out the best possible avenues in addressing not only current issues affecting our products and services but also being mindful of the future as well.

SUSTAINABILITY MISSION STATEMENT The Group will work together with the Government in developing the nation and in promoting economic growth. The Company believes that increases in business activities within the country would have a favourable impact towards the country’s economic stability as well as the Group’s well-being. We will conduct our business in a socially responsible and ethical manner. We respect the law, support human rights and protect the environment. The Group will conduct its business with a view towards long term environmental sustainability and preserving the eco-system and will balance the demand for innovation with the responsibility to do no harm to the environment. The potential environmental impact will be considered when making business decisions and when managing our resources. As people are assets to any organisation, the Group strives to provide a conducive working environment for its employees and projects an image of a caring employer. The Group will recognise and reward outstanding performance as well as provide training and personnel development to attract and retain the most talented and committed employees. CORE AREAS FOR SUSTAINABILITY

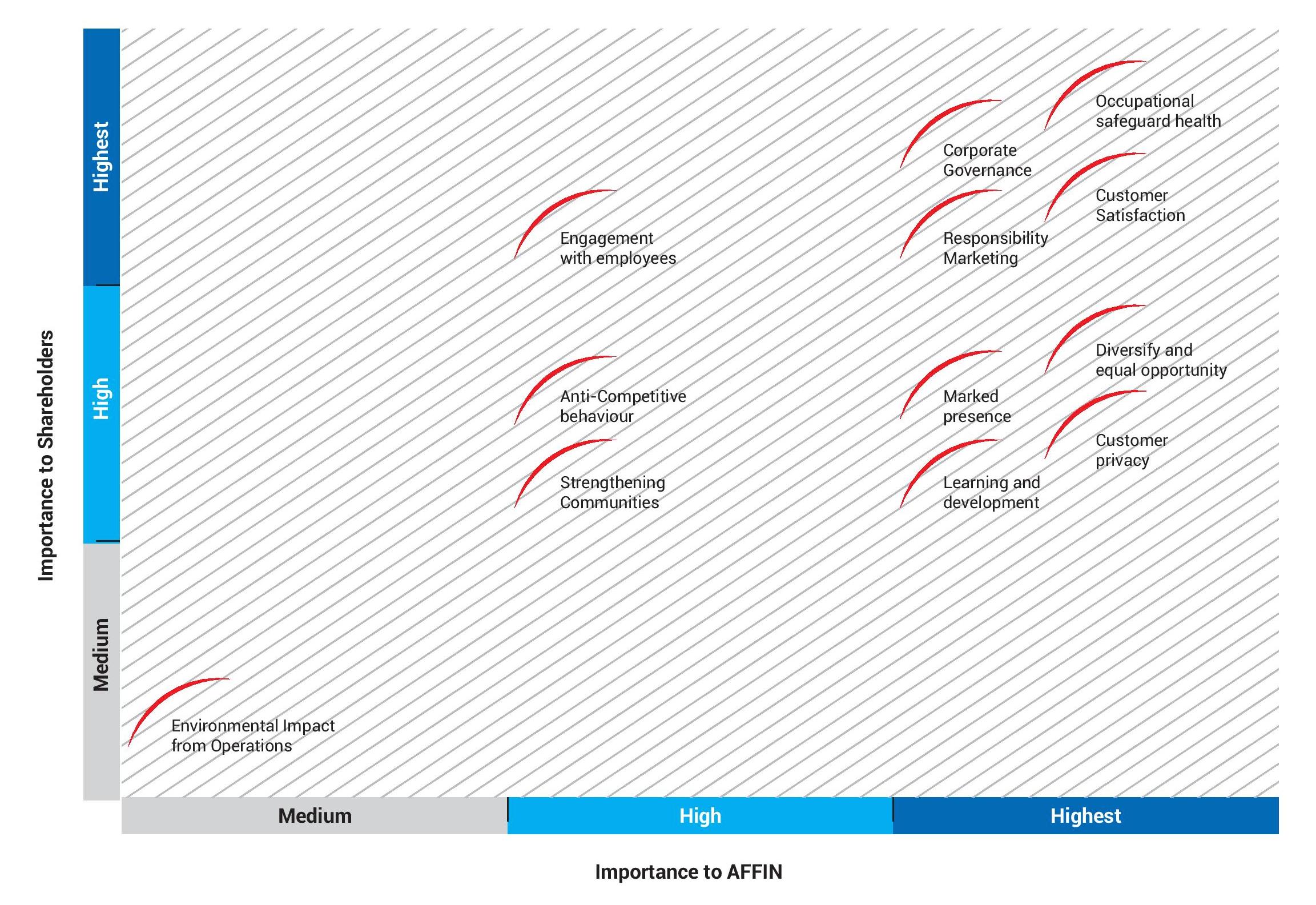

MATERIAL SUSTAINABILITY ISSUES The sustainability report serves to gauge the level of progress of our initiatives on a yearly basis in the areas where we operate. Our day to day business operation does have a bearing on our stakeholders who include employees, customers, shareholders, regulatory bodies and the media amongst others. We are therefore duty bound to provide a clear and accurate assessment of our undertakings to our stakeholders that extend beyond just numbers to include the manner in which we conduct our business as an organisation. UNDERSTANDING MATERIAL ISSUES We understand the importance of key operational, financial and reputational issues that have a bearing on our day to day business and how we engage with our customers and the community at large.

We are always mindful of the constant need to engage our stakeholders on material issues that impact the business. How we prioritise these issues may differ from those of our stakeholders and it is essential that we value and understand their needs and perceptions in order to arrive at an optimal balance that mutually benefits the business, communities and stakeholders alike. We will continue to focus and improve on this important aspect of the business with a more in-depth approach in engaging the various parties within the realm of our business.

SUSTAINABILITY GOVERNANCE We firmly believe in adhering to best practices in all our dealings with our customers, vendors and other stakeholders to ensure long term sustainability for the business. Various ethical and business policies and procedures have been put in place that provide the framework to effectively manage and conduct our business in a responsible and transparent manner. WHISTLE BLOWER POLICY The whistle blower policy is intended to encourage employees to raise serious and genuine concern(s) about any malpractice or wrongdoing by their colleagues with the Group Whistle Blowing Committees, without fear of victimization, harassment, discrimination or intimidation. The policy aims to assure the employees that the concern(s) raised by employees will be handled with high confidentiality. Employees will be protected from reprisals or victimisation if they make the disclosure in good faith. CORPORATE DISCLOSURE POLICY AND PROCEDURES The corporate disclosure policy is to provide accurate, clear, timely and complete disclosure of material information pertaining to the Group’s performance and operations to shareholders, stakeholders, analysts, the investing public or other persons in conformity with applicable legal and regulatory requirements as well as ensuring equal access to such information to avoid individual or selective disclosure. The objectives of this policy are:-

FIT AND PROPER POLICY FOR KEY RESPONSIBLE PERSONS Formalising a Fit and Proper Policy for Key Responsible Persons in line with guidelines set out by Bank Negara Malaysia (“BNM”) to ensure key positions in the Group are led by personnel who fulfil the following criteria:-

This Policy specifies the following:-

CODE OF ETHICS Adopting the Code of Ethics under BNM’s guidelines on the Code of Conduct for Directors, Officers and Employees in the Banking Industry (“BNM/GP7”) as part of Rules and Regulations by the banking subsidiaries to guide its employees based on the following key principles:-

ANTI-FRAUD POLICY Establishing the Anti-Fraud Policy which spells out the roles and responsibilities of each employee in the Group in preventing, detecting and reporting any defalcations, misappropriations and irregularities as well as disciplinary actions on employees involved in fraudulent acts. The Anti-Fraud Policy seeks to:-

ANTI-MONEY LAUNDERING POLICY To corroborate with the Government’s and BNM’s initiatives in preventing the use of the banking system for illicit and money laundering activities as well as the financing of terrorist activities, the Group has set up an extensive infrastructure and processes to support such efforts. A key component of this infrastructure is the Group’s Anti-Money Laundering Policy which sets out the following:-

Some of the key policies and procedures that enable us to manage sustainability effectively are as follows:-

RISK CULTURE The inculcation of a risk awareness culture is a key aspect of an effective enterprise-wide risk management framework. The key factors of the Group’s risk culture are as follows:-

An important aspect of the AFFINITY programme is the Risk and Compliance Management Pillar which is intended to embed deep appreciation and understanding of ethics, risk and compliance into day to day business activities and processes. AHB is collaborating with Asian Banking School to conduct a customised in-house training programme entitled “Ethics, Risk and Compliance Culture Awareness”. MANAGING REGULATORY CHANGE As we operate in an ever-changing environment, managing regulatory change is inevitable. We aim to continue embedding regulatory best practices in our operations. To do this, we have operationalised Group-wide risk and regulatory professionals who will not only address issues but work together to prevent issues in order to ensure long-term stability and growth of the markets we operate in and achieve our own growth aspirations. BUSINESS DRIVEN SUSTAINABILITY ACTIVITIES IN 2016REACHING OUT TO COMMUNITY THROUGH SPECIFIC PRODUCTS Given that our major shareholder is Lembaga Tabung Angkatan Tentera (LTAT), the Group has a tradition of contributing to retired and serving Armed Forces personnel and families. In 2016, a total of RM2.0 million was channelled to Yayasan LTAT, with RM1.0 million each contributed by AHB and Affin Hwang Capital. Yayasan LTAT is a foundation established to raise funds for scholarships and provide education assistance to the children of retired and serving Malaysian Armed Forces personnel. In 2016, AHB contributed two hemodialysis machines worth about RM92,000.00 to Hospital Angkatan Tentera, Kem Terendak, Melaka and Hospital Angkatan Tentera Tuanku MIzan, Wangsa Maju, Kuala Lumpur. The contribution is part of its tradition of caring for the welfare of retired and serving Armed Forces personnel and their families. AFFIN ISLAMIC’s AFFIN Barakah Charity Account-i offers its account holders an easy and convenient opportunity to donate their monthly earned profit/dividend 'hibah' to charity. To date RM101,988.34 has been donated to various charity bodies through AFFIN Barakah Charity Account-i including wheelchairs worth RM18,500 being donated to the Kuala Lumpur Hospital (“HKL”) in 2016. Other than HKL, funds raised from AFFIN Barakah Charity Account-i were previously donated to Persatuan Pesakit Parah Miskin Malaysia, Selangor & Federal Territory Association for Mentally Handicapped, Rumah Kanak-Kanak Taiping, Yayasan Kanser Malaysia and Pemulihan Dalam Komuniti (“PDK”) Kasih Autisma.

AFFIN ISLAMIC also collaborated with AFFINBANK on several corporate sustainability initiatives to engage the communities at large. These included a ‘Majlis Berbuka Puasa Bersama Anak-Anak Yatim, jointly sponsoring Utusan Malaysia’s Tutor Pull-out Programme where specially prepared Tutor Pull-outs were distributed to primary and secondary school students. Affin Hwang Capital empowers underprivileged communities and support their means of livelihood by engaging them as vendors for activities such as festive hampers to clients, catering for events, and other related entrepreneurial activities. During Ramadhan, Affin Hwang Capital handed out zakat to 17 eligible beneficiaries at our zakat giving ceremony. The zakat beneficiaries included schools, old folk’s homes, orphanages and other benevolent bodies. During the year, Affin Hwang Capital also teamed up with Yayasan Salam Malaysia and brought underprivileged children on a shopping outing in preparation for Raya celebration. AXA AFFIN Life Insurance continued its strategic partnership with the National Cancer Society of Malaysia by introducing cancer related products incorporating CSR elements. 110 Cancer Care products were launched and sold online while 110 CI Care were sold by distributors. For each of the two products sold, single usage of the Chemotherapy Day Care Unit per patient at NCSM’s cancer treatment Centre was sponsored by the company. GROWING THE BUSINESS THROUGH PEOPLE AND PERSONAL DEVELOPMENT We constantly review current and future business requirements and its impact on resourcing, training and talent needs. More than RM14.5 million was spent by AFFINBANK, Affin Hwang Capital, AXA AFFIN Life Insurance, AXA AFFIN General Insurance and AFFIN Moneybrokers during the financial year on training and development to increase the knowledge and skills of employees in performing specific jobs as well as continued professional development training for licensing, compliance, technical, soft skills, leadership as well as teambuilding in striving towards achieving professional excellence in the long term.

The staff development plan entails training and identification of needs through the performance management process or needs management. Training and development programmes like AFFINBANK’s Leadership Development, Young Talent and Upward Mobility programmes, education sponsorships, talent retention and acquisition as well as succession planning are conducted by various subsidiaries as part of the long-term progression initiatives for staff in the Group. 2016 also saw the successful implementation of the Management Trainee Programme, a talent recruitment process that harnesses the true potential of candidates by putting emphasis on the “people” and accelerated through dedicated training and support. It is a long-term commitment, which proactively identifies individuals who will enrich our teams with their diversity, experiences and unique perspectives. AFFIN Hwang Asset Management in December 2016 launched “Beyond The Classroom Wall” Financial Literacy Workshop, a programme designed to instil awareness surrounding financial literacy among young adults age 11–17 years old and designed to encourage learning through role- playing activities. CREATING A CONDUCIVE AND SAFE WORKING ENVIRONMENT WITH CAREER ADVANCEMENT OPPORTUNITIES Various policies and procedures are in place in AFFINBANK, Affin Hwang Capital, AXA AFFIN Life Insurance, AXA AFFIN General Insurance and AFFIN Moneybrokers to ensure the well-being of employees namely talent management acquisition policy and procedures, managing compensation and benefits including insurance coverage, Performance Management System, term and conditions of employment and employee relations as well as the Occupational Safety and Health Act. Policies on health and safety, sexual harassment and workplace violence have also been introduced for the betterment of staff. ONLINE SURVEY AND ‘LIVE CHAT’ LAUNCHED TO ENHANCE THE CUSTOMER EXPERIENCE Enhancing the customer experience is an ongoing priority and AXA AFFIN General Insurance conducts the CXT satisfaction and Net Promoter Score surveys quarterly and annually respectively. While results have been consistent, there is active engagement with customers to further improve the overall experience. AXA AFFIN Life Insurance evaluates customer satisfaction through a survey called ‘Customer Scope’, conducted twice a year. The online survey, successfully launched in 2016 revolves around ‘I am New Customer’ which applies to new customers who bought a policy in the past 6 months and ‘I have General Request’ targeted at existing customers who interacted with AXA AFFIN Life Insurance in the past 6 months. Feedback received will provide important information in addressing and solving issues that our customers face. Other transformation initiatives launched to improve the overall customer experience, included the ‘Learn My Protection’ portal, a community portal dedicated to health protection, preventive measures and promoting life skills and the setting up of a live web chat on the AXA AFFIN Life Insurance website offering easy information access on various products. TOWARDS A SUSTAINABLE WORKING ENVIRONMENT AFFINBANK and AFFIN ISLAMIC also jointly sponsored the ‘My Coral: MSU Eco-Marine Youth Expedition 2016’ involving coral reef plantation, turtle sanctuaries, beach cleaning and free medical check-ups for the local community to increase awareness on nature preservation and emphasise the importance of basic health checks. Various eco-friendly measures have been initiated and encouraged by subsidiaries as part of sustainability efforts in the workplace. Affin Hwang Capital management and staff actively participated in “green” policies efforts such as to reduce paper use by going digital and adopting e-statements for both staff and customers. The subsidiary also underwent an office renovation and relocation exercise incorporating energy saving efficient features which included LED instead of fluorescent lighting and segregated split unit air conditioning zones compared to centralized air conditioning allowing a more cost effective use of air conditioning especially after office hours. AXA AFFIN Life Insurance launched several internal environment friendly programs involving the collection of recycled papers and materials to reduce paper printing while AXA AFFIN General Insurance partnered with WWF Malaysia to support their conversation activities.

ZAKAT INITIATIVES In 2016, AFFIN ISLAMIC contributed a total of RM3.1 million in zakat to different causes and sectors of the underserved population. AFFIN ISLAMIC contributed a total of RM1.1 million to deserving individuals and charitable organisations. The Bank contributed a total of RM1 million to 10 state zakat centres (Johor, Perak, Selangor, Perlis, Kedah, Melaka, Kelantan, Terengganu, Kuala Lumpur and Pulau Pinang). A total of RM207,740 was channelled towards knowledge causes (Fisabillilah), inclusive of Muallaf activities. On the educational aid, AFFIN ISLAMIC contributed RM450,000 to support deserving students pursuing tertiary education at local universities of higher learning such as Universiti Teknologi MARA (UiTM), Management & Science University (MSU), Universiti Putra Malaysia (UPM) and Universiti Kebangsaan Malaysia (UKM). In addition, AFFIN ISLAMIC contributed RM350,000 to Tabung Zakat Angkatan Tentera Malaysia, which manages funds to be allocated to deserving members of the armed forces. |

||||||||||||||||||||||||||||||||||||||

|

|

|